- HOW DO YOU CHANGE CURRENCY IN QUICKBOOKS SOFTWARE

- HOW DO YOU CHANGE CURRENCY IN QUICKBOOKS PASSWORD

- HOW DO YOU CHANGE CURRENCY IN QUICKBOOKS DOWNLOAD

- HOW DO YOU CHANGE CURRENCY IN QUICKBOOKS WINDOWS

If you have more than that, you’ll need a transaction aggregator. There's an upload limit of 4,000 cryptocurrency transactions in TurboTax.

HOW DO YOU CHANGE CURRENCY IN QUICKBOOKS DOWNLOAD

The most common way to do this is to download your order or trading history from your exchange’s website. It’s your responsibility to keep records of your transactions. You may receive various types of forms, including a 1099-K, 1099-B, and/or a gain and loss report. Cryptocurrency exchanges aren't required to provide a 1099-B or summary tax statement for cryptocurrency transactions. If you bought coins at different prices or sold partial amounts, then you have to keep track and record the difference of what you sold. You have to do this for every trade you made.

When it comes to hard forks and airdrops, you only have taxable income if it results in new cryptocurrency. You'll need to report your cryptocurrency if you sold, exchanged, spent or converted it. Note: Leave the 0.00 in the Ending Balance field. Select the desired Currency, click Next, and then click Done. Enter an Account Name that differs from the original account, select the Financial Institution, and then click Next.

HOW DO YOU CHANGE CURRENCY IN QUICKBOOKS SOFTWARE

Alternatively, you can just enter the username you created and the software picks up on the password.Reporting cryptocurrency is similar to reporting a stock sale. Select the account type under the Cash Flow heading and click Next. Quick reminder – as an admin you just need to provide the password, there is no need for the username.

HOW DO YOU CHANGE CURRENCY IN QUICKBOOKS PASSWORD

If You Know the Passwordįirst, you need to figure out the type of password you’d like to change admin or user. The steps are similar to the previously described but let’s see what you need to do.

HOW DO YOU CHANGE CURRENCY IN QUICKBOOKS WINDOWS

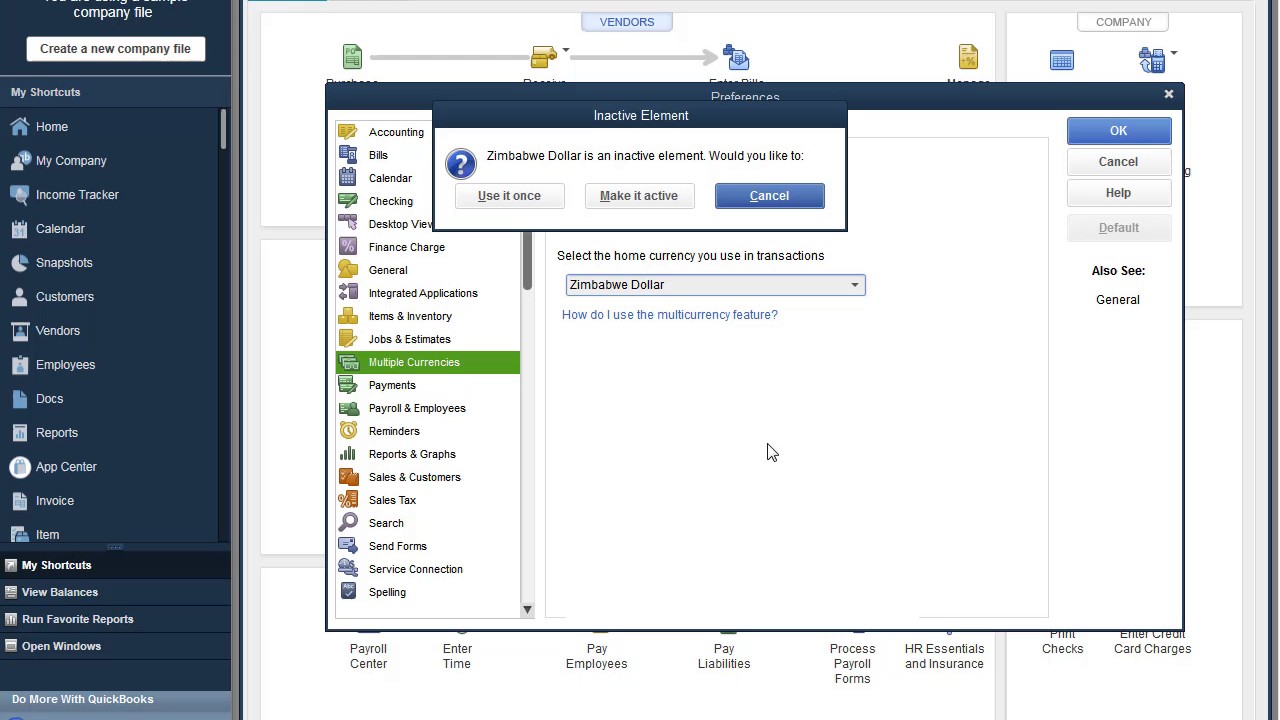

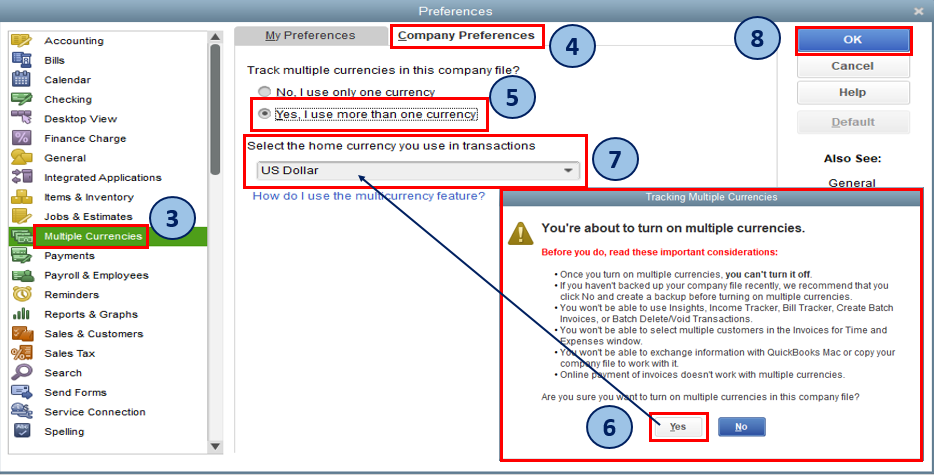

That being said, Windows version does feature the “I forgot password” option. You should manually reconcile such transactions. Chargebee syncs the exchange rate used in Stripe to QuickBooks. If you have multiple currencies in Chargebee and a single bank account in Stripe, Stripe applies the exchange rate while processing payments. Open your QuickBooks account and go to the Edit menu, click on Preferences. You can contact email protected to avail gateway statement based on currencies. QuickBooks Desktop – Changing/Resetting the Passwordįor the following steps to work, you need to know your password. You can change the password if you lost it or forgot it. Important Note: If you have other Inuit apps like Mint or TurboTax, changing the password affects all of them. The steps may vary slightly depending on what you’ve forgotten. Before we start, please know that you can no longer deactivate the feature once its turned on. As a workaround, you can consider utilizing the Multicurrency feature to set US dollars (USD) as your home currency. Again, you should follow the on-screen wizard to set up a new password or ID. Once you select the home currency during the initial setup of your QBDT software, the option to change it is currently unavailable. What to Do If You’ve Forgotten Password/QuickBooks ID?Īccess the QuickBooks “Sign In” section and click on “I forgot my User ID or Password.” It is located just under the “Sign In” button.

0 kommentar(er)

0 kommentar(er)